The recycling of precious metals is at a new high, however the industry is facing many challenges. This situation was clear at the IPMI seminar in Atlanta in April 2019. The presentations on this topic generated a lot of interest during the well-attended event at which equally large numbers of representatives from the precious metal markets and the automotive catalytic converter recycling sector were present – starting from collectors, through processing organisations, to smelting facilities.

The presentation by Philip Newman from Metals Focus – a well-known consultancy and market research company in the sector of precious metals – primarily addressed the prospects for the supply of platinum and the supply of palladium from mines. He referred to the latest five-year forecast for platinum-group metals. The forecasts for the recycling of automotive catalytic converters were also an aspect here. The recovery of platinum from waste automotive catalytic converters is expected to increase by around 6 % this year and reach a new high of 1.4 million ounces. For palladium, a growth of 5 % to a record figure of 2.5 million ounces from automotive catalytic converters is forecast.

For the future, according to Newman, it is assumed that the quantity of platinum-group metals from old automotive catalytic converters will continue to increase and reach new peaks. This assumption is a positive prospect for the sector. However, the automotive recycling sector is currently facing a series of challenges and these must not be forgotten.

Increasing technical challenges

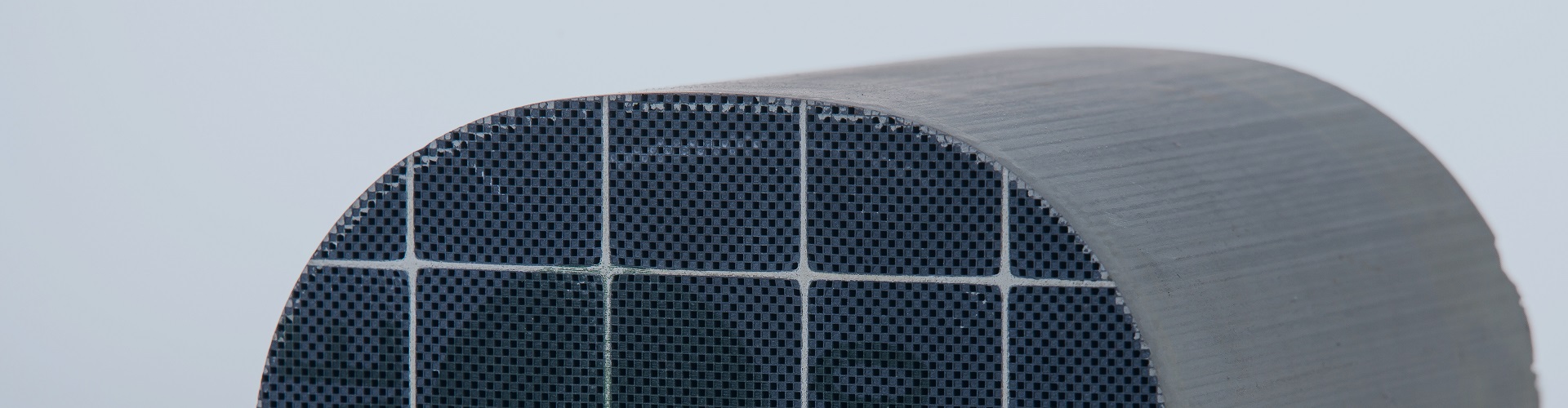

One of the sector’s tasks in the area of diesel particulate filters from cars clearly apparent from the studies by Metals Focus relates to the increasing quantity of diesel particulate filters (DPFs) that contain silicon carbide (SiC). The carbon hinders the extraction of the precious metals during the classic smelting process. As such the material can only be processed by a few smelting facilities, which is already causing bottlenecks in some parts of the value chain. « The quantity of diesel particulate filters containing SiC in the recycling process will significantly further increase in the coming years, we expect the high point in Europe in 2024, in the USA in 2025 », explains Oliver Krestin. From the point of view of a processing facility, he also drew attention to the growing complexity of the catalytic converters used in trucks. These can contain contaminants such as AdBlue residue and fibres. Metals Focus also sees this as an ever-greater challenge because the need for platinum for truck DPFs is continuing to increase – particularly in the growth markets.

Financing precious metals

The increasing volume of capital tied up in financing the collection and recycling processes was addressed by Newman and Krestin. In their one and five-year forecast, Metals Focus expects a powerful upward trend in palladium prices and a less powerful upward trend in platinum prices in the medium term. While this situation should be positive for the recycling volume, the increasing raw material prices will affect the cashflow due to higher interest. In other words – recycling businesses will need to use more capital to purchase the same quantity of catalytic converters; this situation will further intensify with the increasing growth in automotive catalytic converter recycling.